7 Simple Techniques For Ach Processing

Table of ContentsHow Ach Processing can Save You Time, Stress, and Money.10 Simple Techniques For Ach ProcessingThe Buzz on Ach ProcessingAch Processing Things To Know Before You BuyThe 4-Minute Rule for Ach Processing

Straight payments can be utilized by people, businesses, as well as other companies to send cash. If you're paying an expense online with your financial institution account, that's an ACH direct settlement.This debit shows to whom the cash was paid and of what quantity. The individual or entity receiving the money registers it in their savings account as an ACH credit history. The previous pulls money from an account while the latter presses it to an additional account. Using ACH transfers to pay bills or make person-to-person repayments supplies numerous advantages, starting with benefit.

In addition, an ACH settlement can be extra safe and secure than various other types of repayment. Sending and obtaining ACH settlements is normally quick.

Ach Processing - The Facts

Cord transfers are understood for their rate and are commonly used for same-day service, yet they can sometimes take longer to complete., for circumstances, it might take several service days for the cash to move from one account to one more, after that another few days for the transfer to clear.

There are some prospective downsides to remember when using them to move cash from one financial institution to another, send repayments, or pay costs. Many banks impose limitations on just how much cash you can send through an ACH transfer. There may be per-transaction limitations, day-to-day restrictions, and monthly or regular limitations.

Indicators on Ach Processing You Should Know

Or one type of ACH deal might be unlimited however an additional may not. Banks can also enforce restrictions on transfer destinations. If you go over that limit with several ACH transfers from savings to an additional bank, you could be hit with an excess withdrawal charge.

When you pick to send out an ACH transfer, the time frame matters. That's since not every financial institution sends them for financial institution handling at the same time. There may be a cutoff time whereby you need to get your transfer in to have it refined for the following organization day.

ACH click here for info takes approximately one to three company days to complete as well as is thought about slow-moving in the period of fintech and also instantaneous settlements. Same-Day ACH handling is expanding in order to solve the slow service of the basic ACH system. Same-Day ACH volume increased by 73. 9% in 2021 from 2020, with an overall of 603 million repayments made.

The smart Trick of Ach Processing That Nobody is Discussing

:max_bytes(150000):strip_icc()/how-ach-payments-work-315441-v2-5b4cb9f346e0fb005bd7eeae.png)

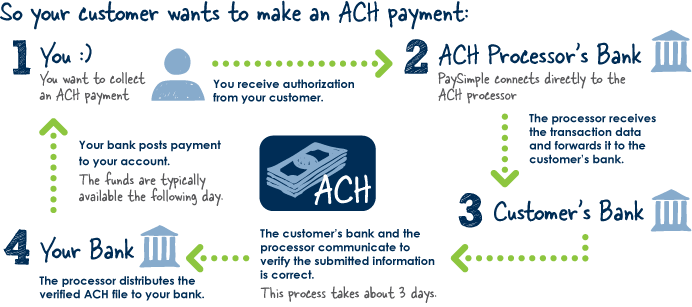

An ACH check this financial institution transfer is an electronic settlement made between financial institutions for payment objectives. ACH bank transfers are made use of for numerous objectives, such as direct down payments of paychecks, financial debts for routine settlements, and cash transfers.

ACH transfers typically take longer to complete; however, same-day ACH transfers are ending up being a lot more usual. ACH is additionally for domestic transfers whereas international transfers are done by wire transfers.

An Unbiased View of Ach Processing

In any case, make certain you recognize your financial institution's plans for ACH direct deposits and direct repayments. Be alert for ACH transfer frauds. A typical scam, for instance, entails a person sending you an e-mail telling you that you're owed money, and also all you require to do to get it is provide your savings account number and also directing my latest blog post number.

Editor's note: This short article was first released April 29, 2020 as well as last updated January 13, 2022 ACH stands for Automated Clearing up Home, an U.S. economic network utilized for electronic settlements as well as money transfers. Additionally referred to as "direct settlements," ACH repayments are a way to move money from one financial institution account to one more without using paper checks, charge card networks, cord transfers, or money.

The ACH network refined more than 25 billion digital payments in 2016, completing $43 trillion, an increase of even more than five percent over 2015. As a consumer, it's most likely you're already acquainted with ACH payments, although you could not be aware of the lingo. If you pay your bills digitally (rather than writing a check or going into a bank card number) or obtain direct down payment from your company, the ACH network is probably at job.

Comments on “Some Known Factual Statements About Ach Processing”